Solids Capital is a leading investment platform focused on the Brazilian market, harnessing advanced

technology and deep financial expertise.

Established by experienced industry professionals, we deliver innovative,

data-driven strategies designed to optimize returns and empower investors

with actionable insights.

Our quantitative approach is engineered to provide reliable, long-term returns, adeptly navigating market fluctuations with precision.

We develop unique strategies grounded in original research, offering innovative solutions that stand out in the financial sector.

Our investment decisions are powered by rigorous statistical models, ensuring accuracy and reduced risk exposure.

Enhance your portfolio with expertly diversified investments across multiple asset classes, balancing risk and reward in the Brazilian market.

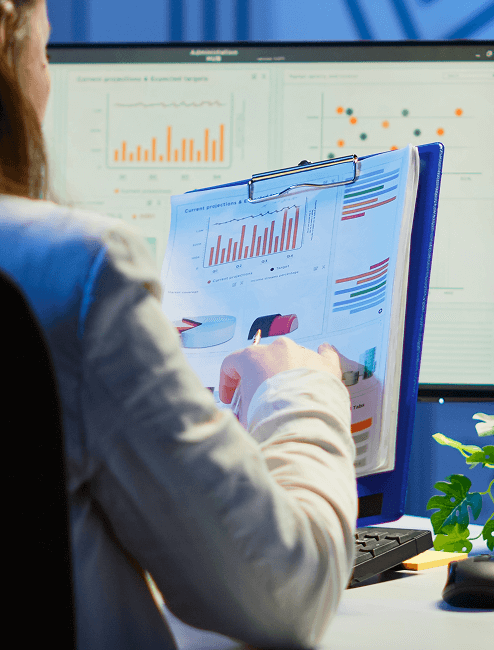

Monitor your investments with real-time performance insights and detailed reporting, keeping you fully informed at all times.

Reinvest your profits into new opportunities or access your returns as immediate liquidity—tailored to your financial goals.

Benefit from personalized guidance by our team of financial specialists, dedicated to optimizing your investment journey.

Solids Capital is dedicated to providing investors worldwide with secure, high-return opportunities in Brazil. Our cutting-edge platform integrates advanced technology, enabling seamless management, monitoring, and growth of your assets—all within an intuitive, user-centric interface.

Solids Capital is dedicated to upholding ethical leadership in finance, ensuring our strategies prioritize integrity and sustainable outcomes for our clients and society.

We leverage our investment expertise to fund initiatives that address global challenges responsibly, aligning profitability with positive societal impact.

The Brazilian fintech market has been gaining significant global

prominence, and Oak HC/FT, with $5 billion in assets, is closely

monitoring this growth.

Brazil possesses a unique combination of regulatory

advancements and cutting-edge technological infrastructure,

which facilitates the emergence of new enterprises and fosters

innovation among major market participants. The Central Bank

(BC) has been identified as a crucial entity in this context, having

established a stable and transparent regulatory environment

over the past decade.

Fintechs are increasingly impressed by the technological and

regulatory developments in Brazil. This favorable environment is

attracting a growing number of international investors, such as

Oak, which perceives significant potential for investments in

fintechs within the country. Credit fintechs have a valuable

opportunity to raise capital in the capital markets, capitalizing on

a landscape characterized by high liquidity and demand for

structured assets

Our competitive advantage lies in the intelligent application of various market tools, combined with our cutting-edge technology and products, facilitating high revenues for our clients